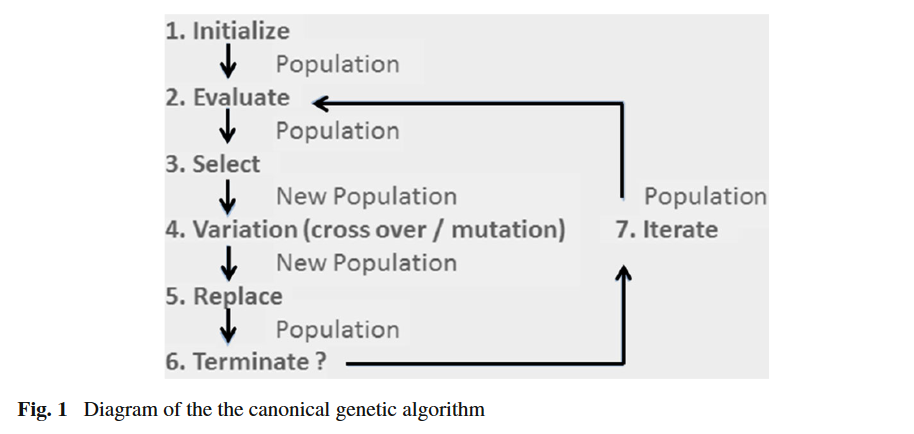

Tax evasion schemes are constantly evolving. There is no systematic method to anticipate the emergence of these schemes. We propose that a properly designed genetic algorithm (GE) is just such a model. We here undertake a brief overview of genetic algorithms and then explain our application of this methodology to the problem at hand.

We employ a variant of the evolutionary algorithm approach known as grammatical evolution. The principal difference between this method and other similar algorithms is in the genetic representation. In GE, chromosomes consist of lists of integers; each integer is called a “codon” Phenotypes are lists of instructions that can be interpreted and executed by other modules of the algorithm.

In our case, the output of production rules results in a list of executable instructions (or “schemes”) which act on previously instantiated Asset and Entity objects. The Asset class may include stocks, promissory notes, loans, cash, options or whatever other instruments are deemed necessary. Entities include individual taxpayers, partnerships, trusts, corporations, banks, etc.

When only terminal symbols are left, they form a list of instructions which is then passed to an interpreter module for execution. The interpreter uses the Asset and Entity objects on the heap to carry out the instructions. Most of which involve pairwise exchanges of Asset objects between Entities.

Auto286