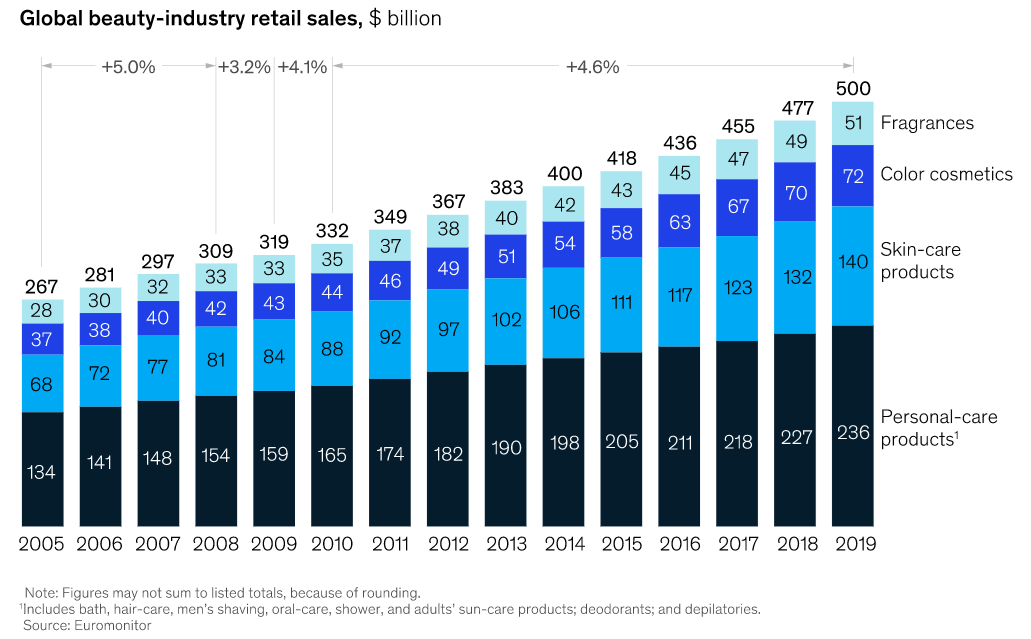

The global beauty industry generates $500 billion in sales a year and accounts for millions of jobs. The industry has responded positively to the crisis, with brands switching their manufacturing to produce hand sanitizers and cleaning agents.

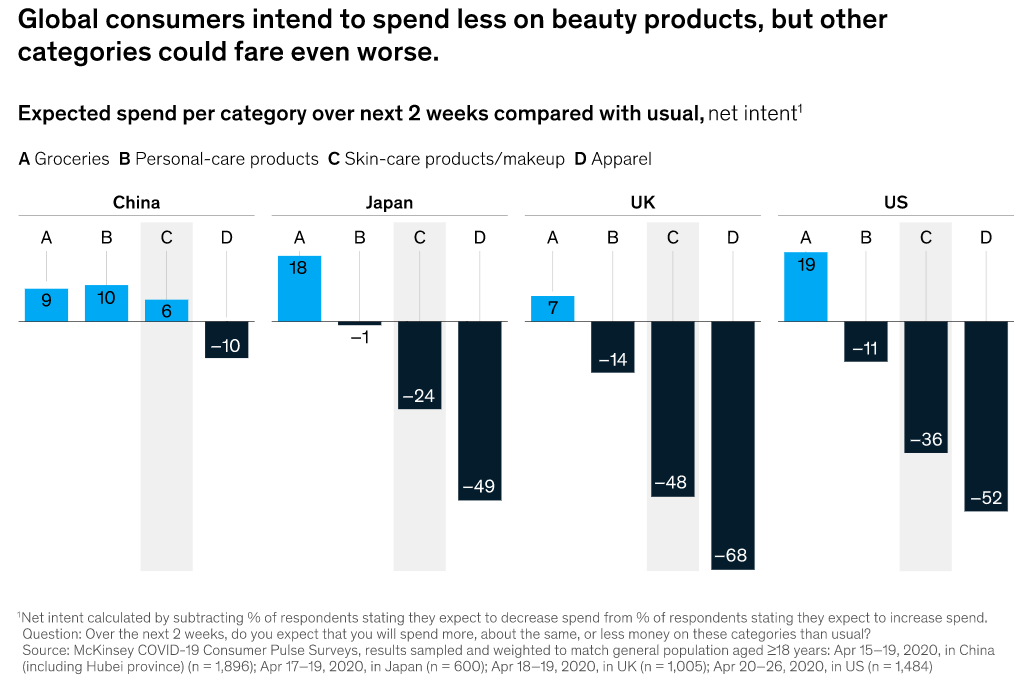

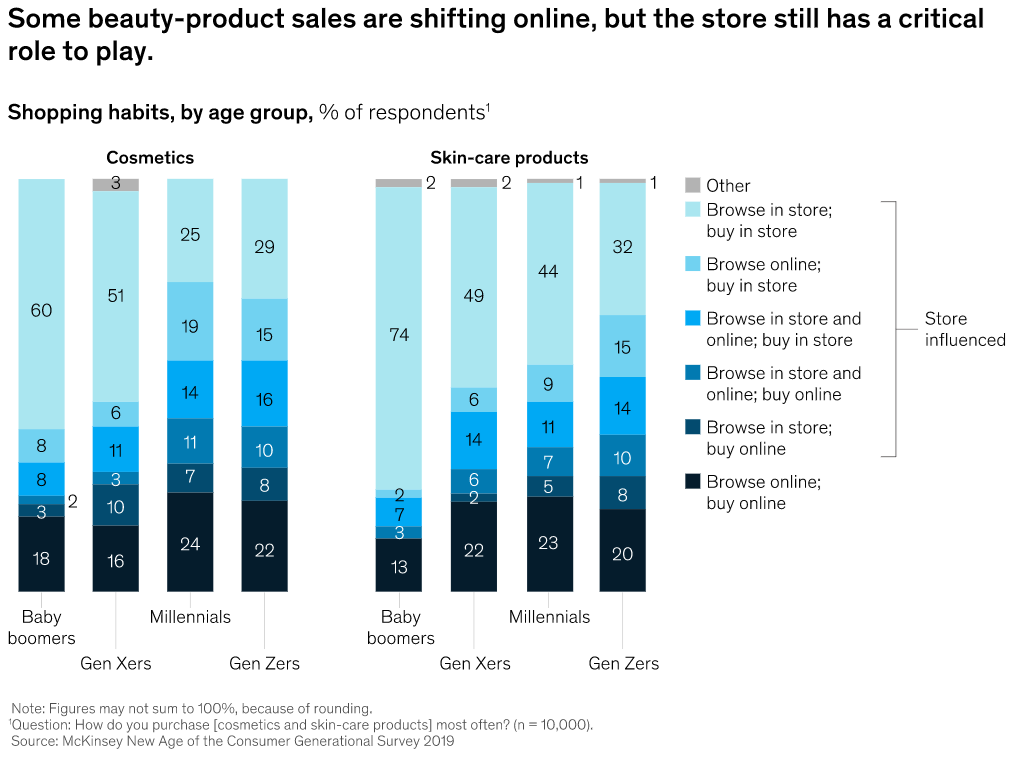

Beauty-product sales at essential retailers are down. Sephora’s US online sales are reportedly up 30 percent versus 2019. Boots UK drugstore chain reported its overall sales fell by two-thirds between March 25 and April 3, 2020, with beauty-product revenues contributing to the decline. China shows the return to in-store shopping could be slow and differentiated. Even after reopening, around 60 percent of large malls in China report a 30 to 70 percent decrease in sales, year on year, in the first quarter of 2020. Promotions also help move unsold seasonal inventory, we expect to see more promotions aimed at reclaiming customer foot traffic.

Another notable trend is the rise of do-it-yourself (DIY) beauty care. Many beauty salons have closed, and even in places where they have not, consumers are forgoing services. Nielsen reported rises in the sales of hair dye and hair clippers by 23 and 166 percent.

Even before the pandemic, brands were under pressure to overhaul their product-innovation pipelines. To achieve it, there may be a greater role for contract manufacturers. There is also potential for closer collaboration between brands and retailers.

The beauty industry may be in a relatively stronger position than other consumer categories, but 2020 will be one of the worst years it has ever endured. The COVID-19 crisis is likely to accelerate trends that were already shaping the market. Consumers across the globe are showing by their actions that they still find comfort in the simple pleasures of a “self-care Sunday”.

Beautytech2 covid19