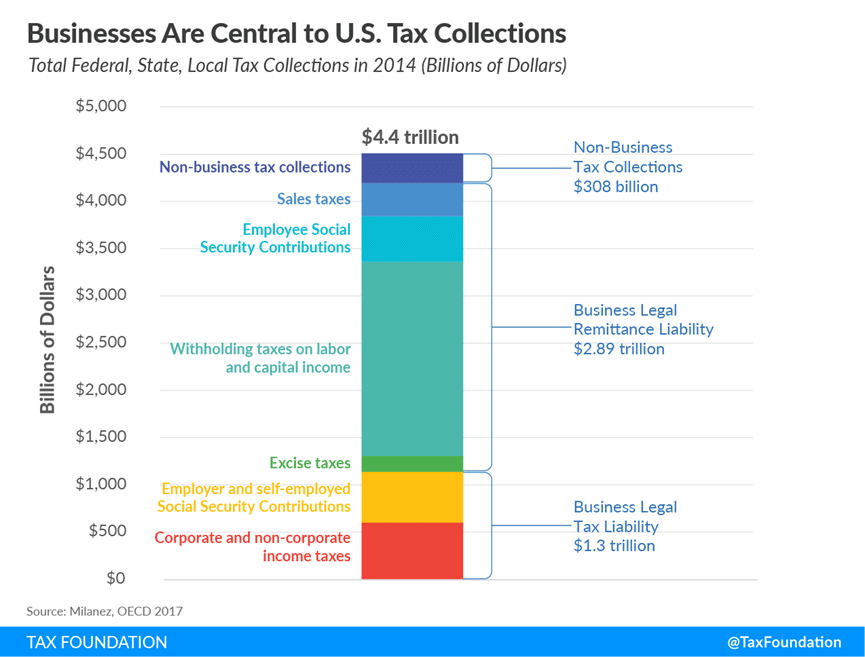

[1] For more detail on the Milanez study, see Scott A. Hodge, “Contrary to ‘Fair Share’ Claims, Businesses are Central to Tax Collection Systems,” Tax Foundation, May 16, 2018, https://taxfoundation.org/fair-share-businesses-central-to-tax-collections/ .

[2] Milanez was unable to estimate property tax payments for U.S. businesses because of data constraints. For all other countries, property taxes on businesses contributed an average of 1.1 percent of total collections. See Anna Milanez, “Legal Tax Liability, Legal Remittance Responsibility and Tax Incidence: Three Dimensions of Business Taxation,” OECD Tax Working Papers No. 32, 2017, 32, https://www.oecd-ilibrary.org/docserver/e7ced3ea-en.pdf?expires=1556811960&id=id&accname=guest&checksum=FDDAD82CC8C9502707C7909211460050 .

[3] In this instance, Milanez is only measuring the legal incidence of payroll taxes, the portion directly paid by businesses. In a later chapter, she discusses the economic incidence of Social Security taxes, which largely fall on workers in the form of lower wages.

https://taxfoundation.org/businesses-pay-remit-93-percent-of-taxes-in-america/