Taxpayers spend 8.1 billion hours a year complying with the Tax Code. Taxpayers also spend $31.9 billion in estimated out-of-pocket costs taxpayers spent on software and professional services. The Tax Cuts and Jobs Act (TCJA) was enacted in December 2017. This analysis will address the compliance burden taxpayers face this year, the impact on complexity from the enacted tax reform law, and the ongoing tax administration and taxpayer service challenges at the IRS.

The TCJA made great strides in reducing the tax burden on individuals and businesses. Though optimism abounds, it remains to be seen what the net effect on the overall level of complexity will be. Congress is already taking steps to change the way the laws themselves are administered, as well as the agency tasked with doing so. Time will tell if these proposals become law, and how much more simplification of tax compliance burdens TCJA can deliver.

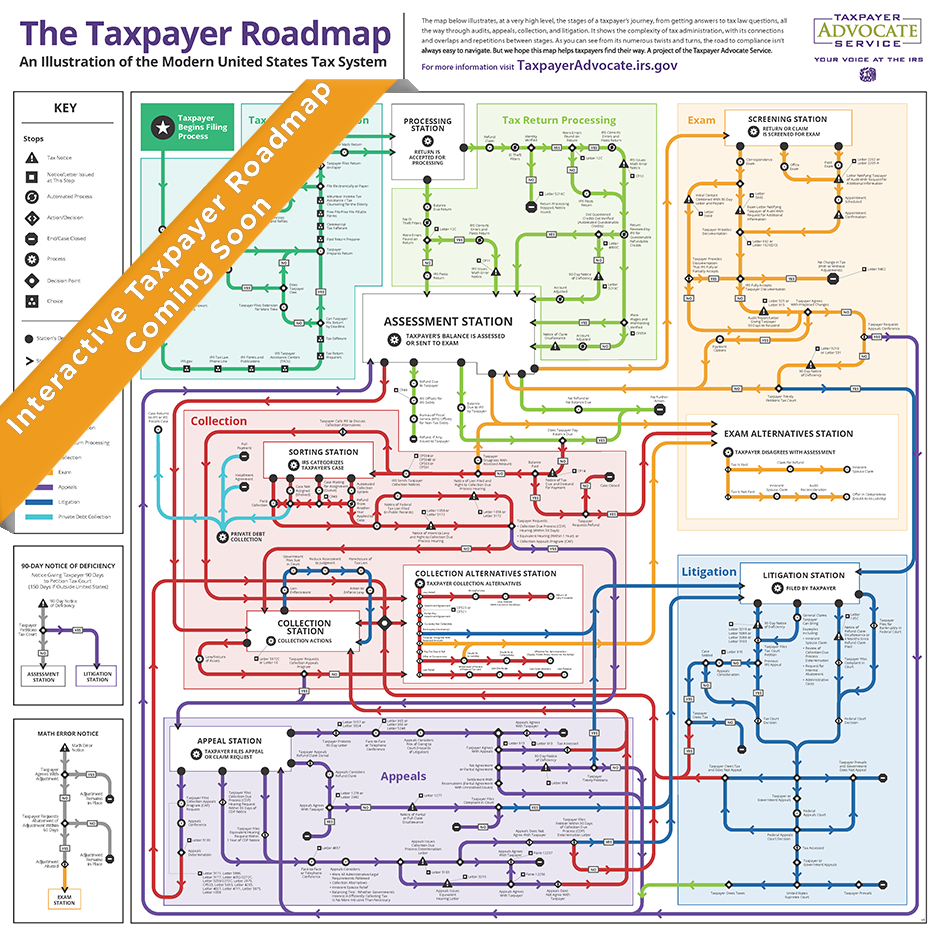

Auto64