Before COVID, 3rd-party food delivery apps such as Grubhub, Ubereats[1], Doordash, Delivery.com, Postmates, Eat24, etc. came along, and they gave restaurant another revenue channel. For just a transaction fee, restaurants would be able to acquire new customers and fulfill online orders – this was an additional source of revenue for the restaurant. Some restaurants did not even need to build an online ordering system, maintain a website, and recruit drivers.

Fast forward to post COVID, the vast majority of restaurants rely on online order and curbside pickup to generate revenue. 3rd party online ordering services no longer makes sense. The reality is all your margins are now in the hands of the 3rd-parties. Restaurant owners are losing money to stay open because they rely on 3rd-party food ordering and delivery services.

Handling Orders

3rd-party ordering systems have different ways of managing orders, some use email, and others use a tablet. This can be a problem when you you are not coordinated to pass orders to the kitchen. If you miss one order, then you get hit with the penalty of a one-star review.

Cost of Transaction Fees

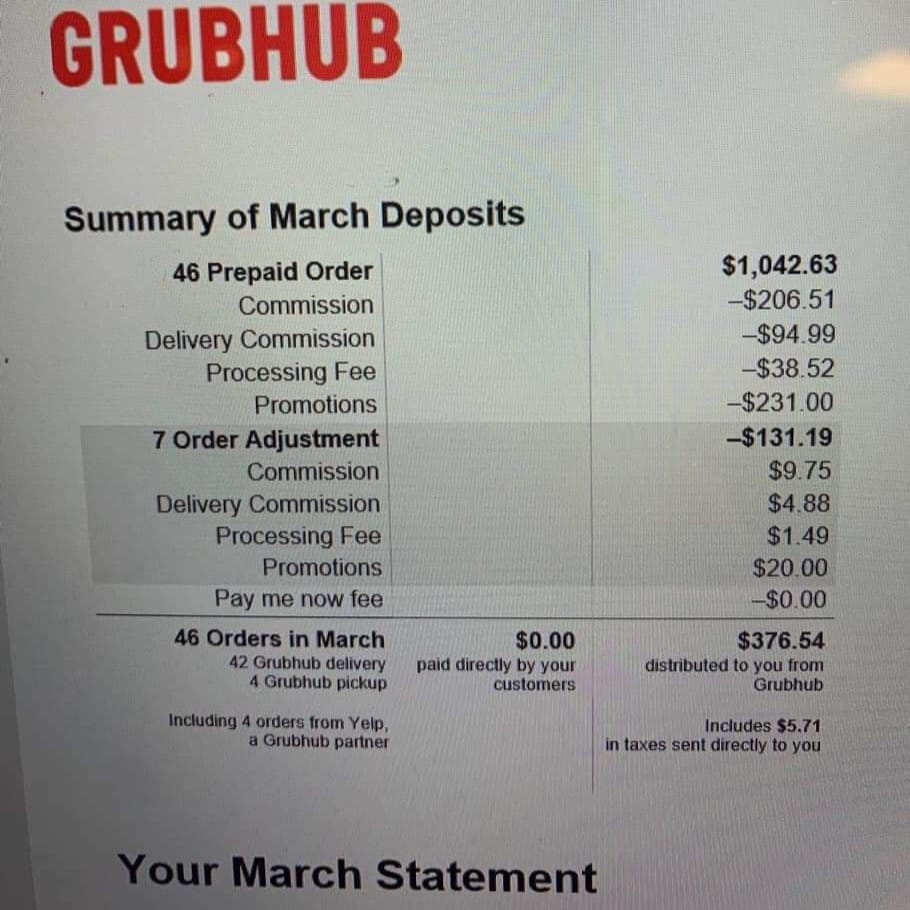

The biggest and not so obvious problem for restaurants is the huge cost that comes with these online orders. 3rd-party websites charge restaurant fees of up to 30% for each order and marketing fees.[2]

It would not be so bad if online orders are only 15% of your total sales, but when they are 100% of your sales, it is impossible to make a profit.[3]

You lost your customers

This is the biggest problem with 3rd party online ordering service. The app own the customer and not the restaurant. Customers order through the service, they pay the service, the app tells them when their food comes, and a driver from the app delivers the food.

It also becomes impossible for a restaurant to market to these customers in the future. When 3rd-party apps control the process, they do not just take the profits, and they also get all of the customer’s data. The restaurant does not get an email address or phone number (in some cases) of the customer that they can use to market to in the future.

According to a 2018 survey by Off-Premise Insights’ 2018 Takeout, Delivery and Catering, 82 percent of customers blame the restaurant and not the driver or the ordering app.[4]

- [1] Uber proposed the acquisition of Grubhub

- [2] https://www.forbes.com/sites/jennysplitter/2020/04/01/grubhub-offers-free-exposure-to-restaurants-struggling-to-survive-covid-19-closures-but-it-comes-with-a-3-rate-increase/#2e58117140cd

- [3] https://www.facebook.com/100001668520076/posts/2990762630989325/?d=n

- [4] https://www.pymnts.com/news/retail/2018/doordash-food-delivery-service-restaurants/