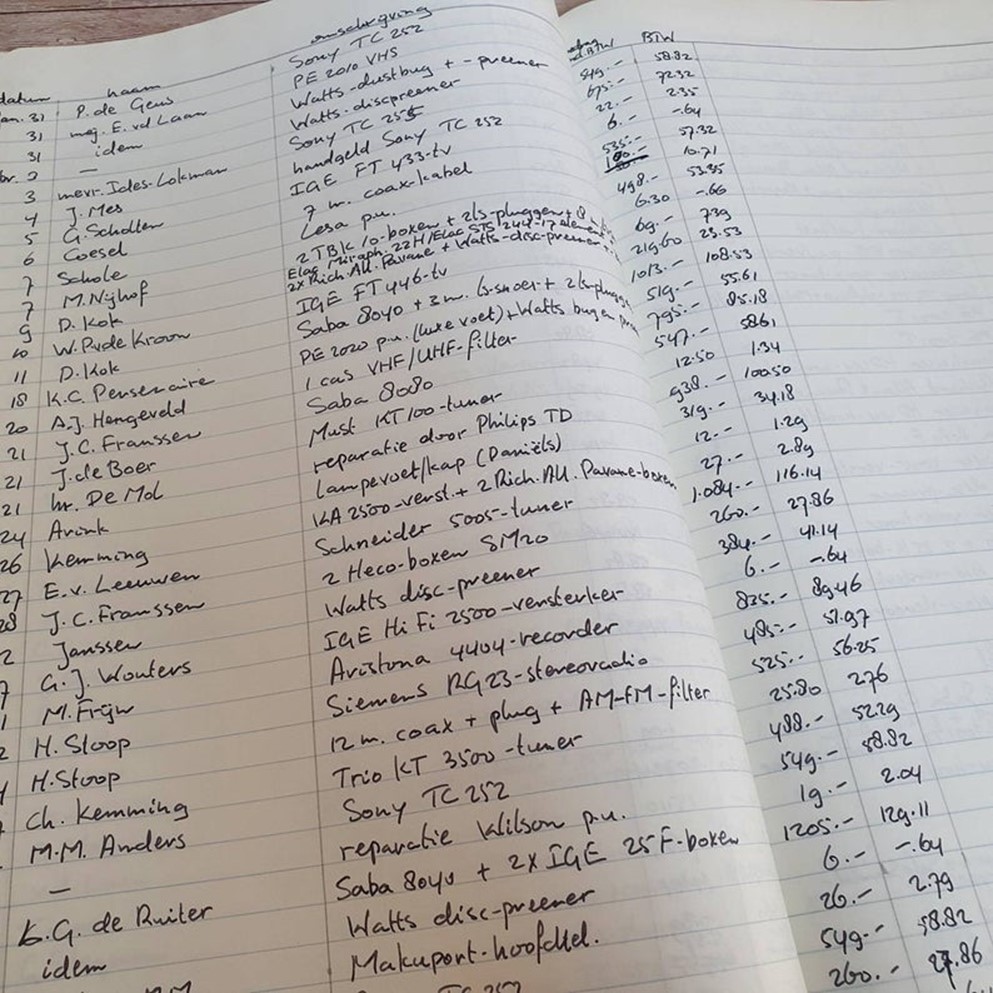

Small organizations often use manual record keeping systems. Even computerized systems may rely on some manual record keeping. A source document is a record that captures the key data of a transaction. Some examples of source documents are employee time cards, purchase orders, sales orders, and cash receipts. The data on a source document usually includes the date, purpose, entity, quantities, and dollar amount of the transaction. It also serves as part of the permanent audit trail. If necessary, the organization can look up the source document to determine the origin and validity of the transactions.

The general ledger provides details for the entire set of accounts used in the organization’s accounting systems. Transactions or transaction summaries are posted to the general ledger from the general journal and special journals. Subsidiary ledgers maintain detailed information regarding routine transactions, with an account established for each entity. The source documents, journals, and ledgers comprise the manual records in a manual accounting system. An automated system improves input efficiency and accuracy by eliminating human error (accounting intelligence). The general journal is used to record nonroutine behaviors and adjusting and closing entries.

As accounting information systems became computerized, the manual processes of record keeping and posting were transferred to automated systems. Until the 1990s, most accounting software consisted of modules, or separate programs, for each business process. Accounting software usually has modules for accounts receivable, accounts payable, payroll, and possibly other processes. Newer IT systems may not use the same structure and are more likely to use fewer paper documents and records. Traditional accounting software systems, often called legacy systems, are described in the next section.

Auto270