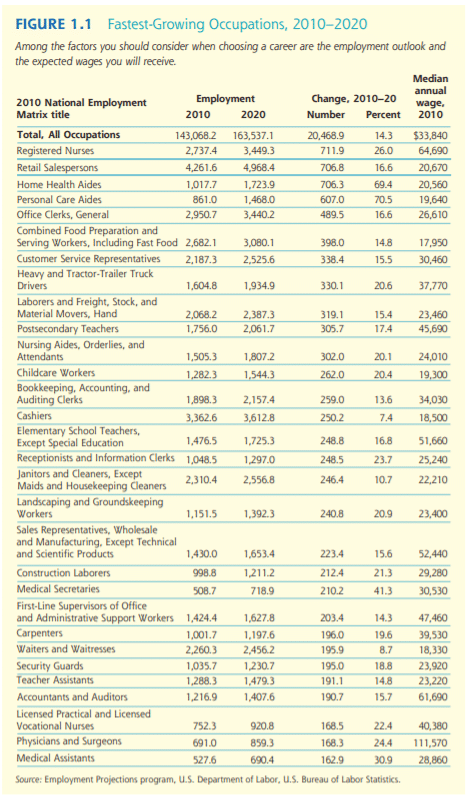

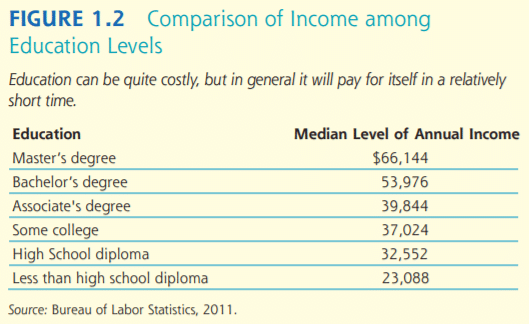

Every one of you needs to create your own personal financial plan. Figure 1.1 lists expected salaries for a number of the fastest growing jobs. In general, the more education you have, the higher your salary. The overall health of the economy also factors in when discussing employment prospects and taxation. Understanding the concepts of credit and borrowing are central to maintaining both short term and long-term financial health. When used wisely, they have the potential to make increased wealth possible. Used improperly, they can lead to financial disaster. Many hardworking people suffer serious problems with credit—simply because they do not plan.

Your liquid assets are those things you might have that can be very rapidly converted to cash without a risk of significant loss. An example of a liquid asset is a savings account at a bank

1.3 million people will file for personal bankruptcy in 2012, according to the American Bankruptcy Institute. More than 30% of high school students use a credit card and more than 80% of undergraduate college students have at least one credit card. About half of all people surveyed who are working full-time in the United States report that they live paycheck to paycheck. – this is NOT financial planning.

Personal financial planning is the process of planning your spending, financing, and investing to create your best possible financial future. You will find that an early knowledge of personal finance can help you avoid common financial pitfalls and accomplish your goals.

Personal Financial Literacy – Second Edition – Madura, Casey, Roberts – Pearson