Step 1

You can categorize your financial goals in terms of when you hope to accomplish them as follows: Short-term goals are those you plan to accomplish within the next year. Intermediate-term Goals are those that you aim to meet within one to five years. Long-term Goal: To have $200,000 in total wealth by age 40.

It is essential that you set realistic goals. Goals must be achievable. If you focus on unrealistic goals, you will likely become discouraged when you do not achieve them. A long-term goal might be to save enough money for the down payment on a house in the next 10 years.

Step 2

You need an accurate picture of your current personal and financial situation. People make different decisions at age 18 than at age 50. Financial goals are tied to your income and your choice of career. Having a good, solid income allows you to set more and loftier goals.

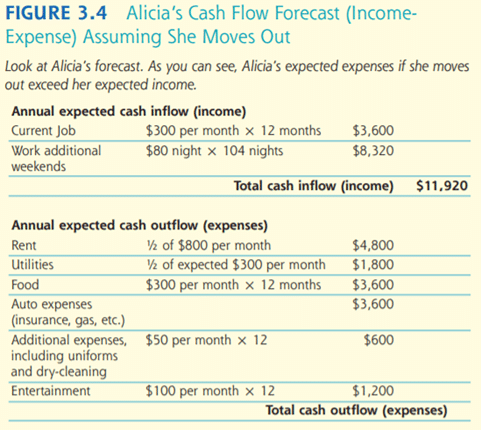

This decision may be right for some people at some times. It may even allow these two young women to reach their short-term goals more quickly. But Alicia is correct to consider the impact of this decision on her long-term financial well-being.

An expense is anything on which we spend money. Examples include the phone bill and car payments. Fixed expenses, by definition, remain the same from period to period. Other expenses may be variable, or change from one period to the next.

Step 3

Alicia’s goal is to move out of her house while attending college. She wants to create a budget in which she can afford the rent and additional expenses. She is also thinking about taking a loan to help pay for college expenses. Alicia might consider getting education at a less costly school.

Personal Financial Literacy – Second Edition – Madura, Casey, Roberts – Pearson