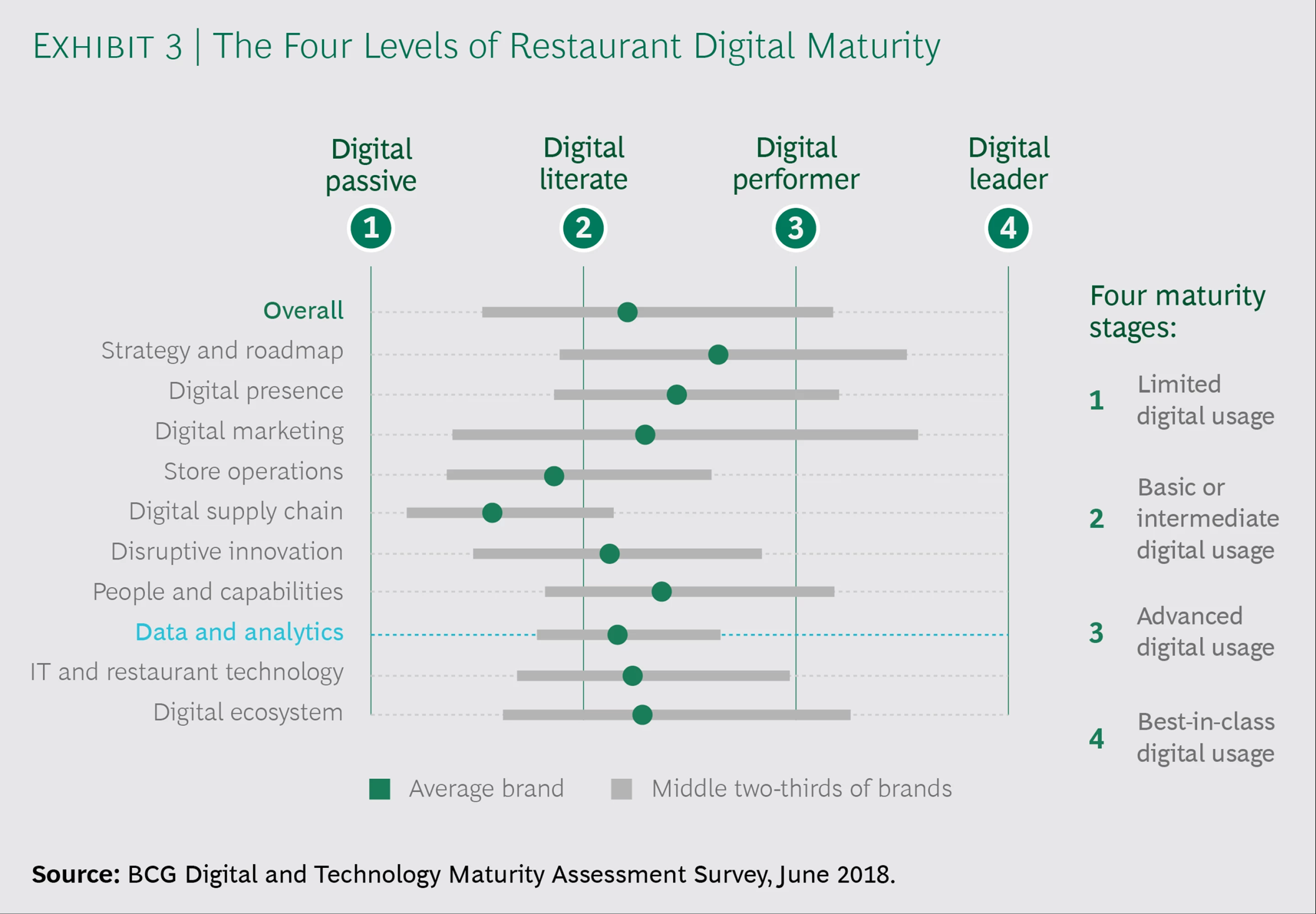

BCG’s 2018 digital maturity survey of top restaurant brands found that four in five brands can access a wealth of data from multiple sources. But only one in five has in place a comprehensive big data strategy, an integrated customer master data set that the entire organization can access. Not a single brand self-identified as fluent in advanced analytics techniques such as artificial intelligence, machine learning, chatbots, or voice-enabled ordering. Brands that delay could find themselves on the losing side of the data divide, says BCG’s John Rizzo. The threat to restaurant companies that move slowly may be more important, he says.

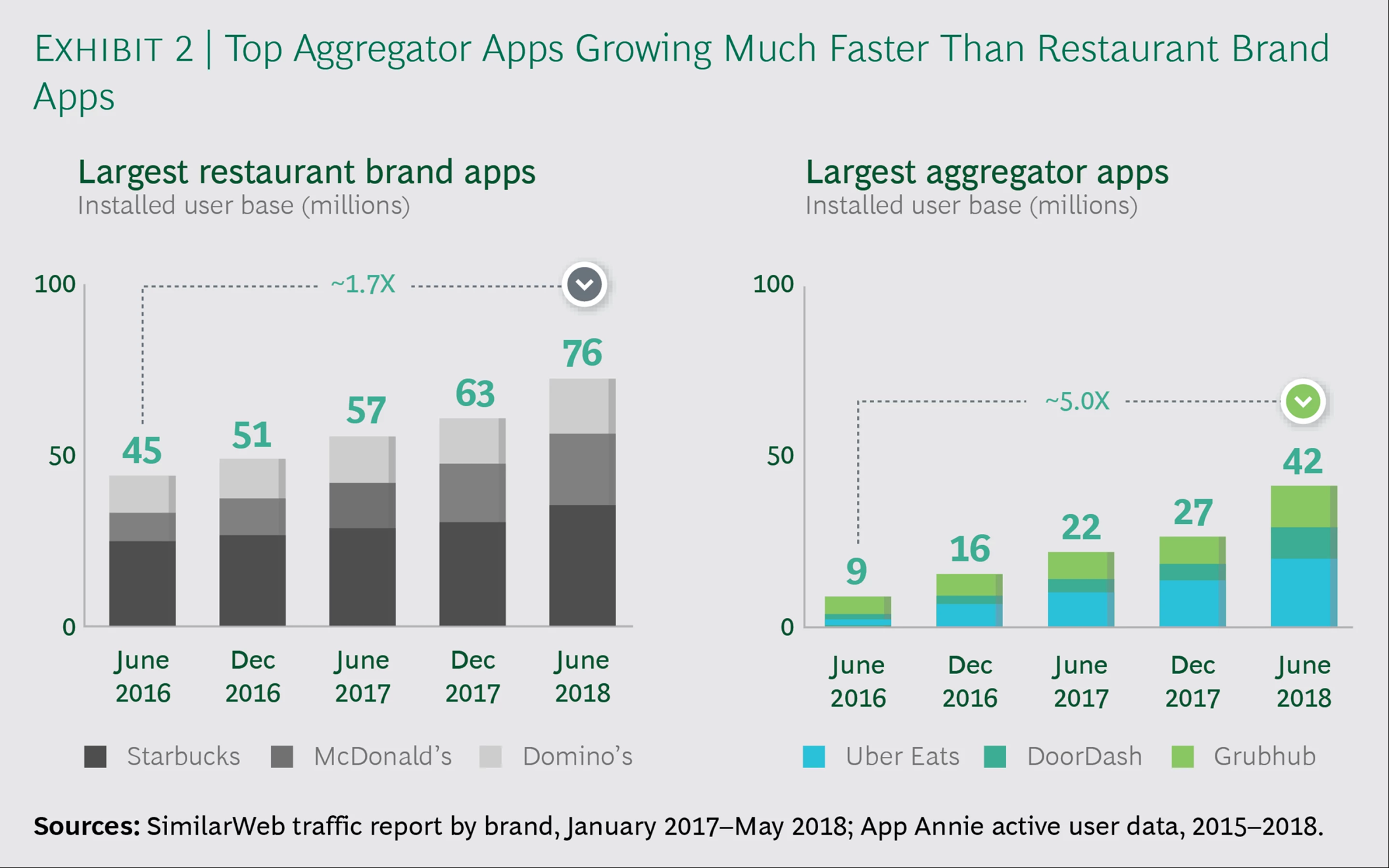

From June 2016 to June 2018, restaurant delivery mobile app sessions increased by almost 400%. US restaurant loyalty programs now have a combined 130 million members. Dining is the fastest-growing industry for loyalty programs. Four in five restaurant app users cite ease of ordering as the app’s most important attribute.. The amount of time customers expect to devote to placing an order has fallen from about 5.5 minutes in 2017 to about 3. 5 minutes in 2018, primarily because of the proliferation of easy-to-use interfaces from aggregators and leading brands.. 40% of app users say that they increased their visit frequency after downloading the app.

Brands are expanding from traditional structured data to new sources of unstructured data. The resulting explosion of data requires new ways of storing and manipulating it. Historically, restaurant brands have used Excel-based modeling to gain insight from data.

The true power of data emerges when it becomes predictive, prescriptive, and fully integrated into business processes. Take customer segmentation. Brands can track behavior at an individual level, run it through an optimization algorithm to find the perfect offer for a specific customer.

A fairly steep maturity curve is already emerging in how restaurant brands use data. Most major brands have made investments. A number of brands are becoming discouraged as investments return less than expected or presage lengthy payback periods of three or more years.

Fastfood3