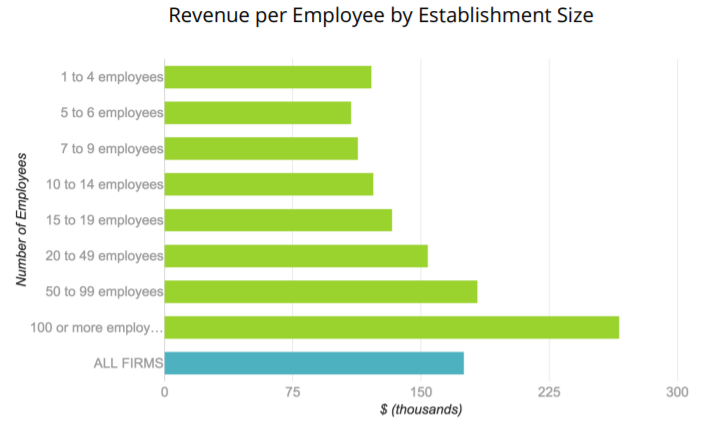

- The average CPA practice has just under $2 million in annual revenue and 9 employees.

- Any accountant filing a report with the SEC is required to be a Certified Public Accountant (CPA).

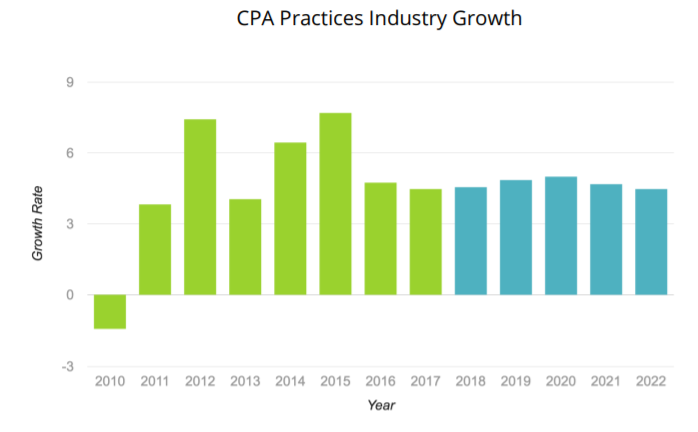

- There are about 53,300 CPA firms in the US operating about 56,500 locations and generating about $97 billion in annual revenue.

- 664,532 (2016) Active CPA Licenses in the USA.

- About 88% of firms have less than 10 employees.

- About 40% of firms are single CPA practices with no employees.

- CPAs are licensed by their State Board of Accountancy. All States require passage of the Uniform

- CPA Examination prepared by the American Institute of Certified Public Accountants (AICPA) for

- licensing. Less than half of candidates pass all four parts of the exam on their first try.

- Nearly all States require CPAs to complete a specific number of continuing education hours before

- their license can be renewed.

- The business structure of CPA practices is 12% corporations, 55% S-corporations, 17% individual proprietorships, and 15% partnerships.

- 26% of CPA practices are female-owned and 12% are minority-owned.

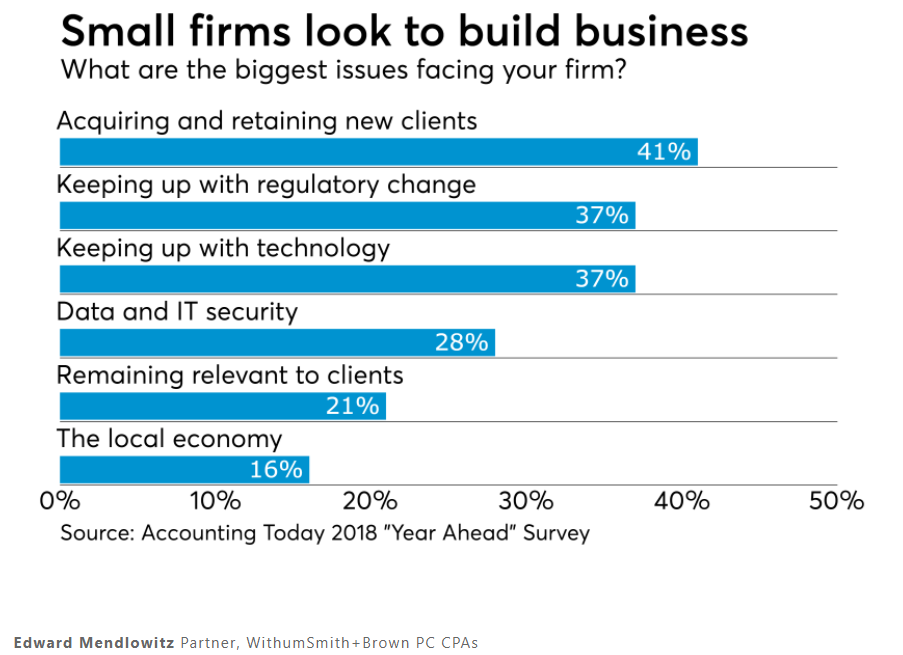

Art of Accounting: Small firms outnumber large firms 91 to 1