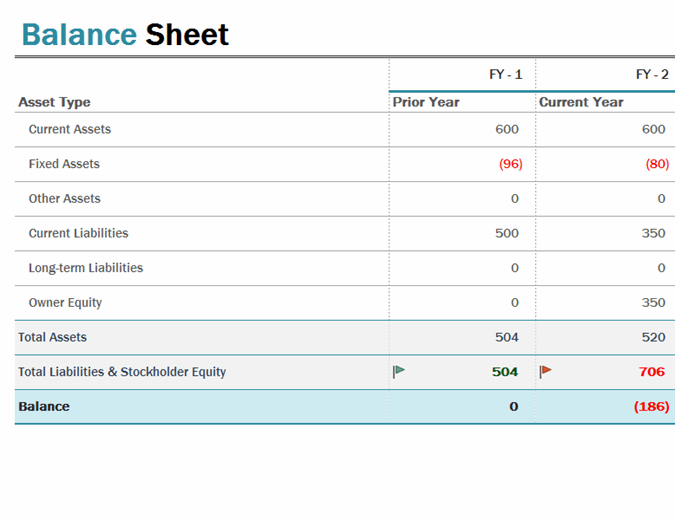

A balance sheet is designed to communicate the “book value” of a company. It’s a simple accounting of all of the company’s assets, liabilities, and shareholders’ equity, and offers analysts a quick snapshot of how a company is performing and expects to perform.

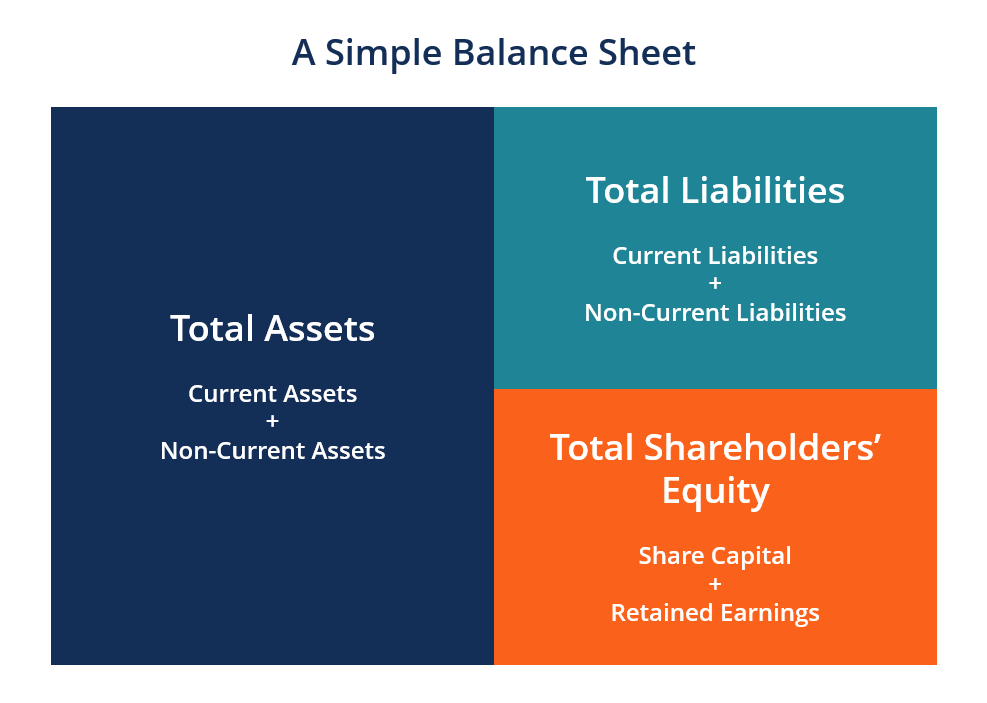

Most balance sheets follow this basic formula:

Assets = Liabilities + Shareholders’ Equity

An asset is anything the company owns which has a quantifiable value. This may include physical property (vehicles, real estate, unsold inventory, etc.), as well as non-physical property (patents, trademarks, etc.).

Liabilities refer to money the company owes to a debtor. This may include outstanding payroll expenses, debt payments, rent and utility payments, money owed to suppliers, taxes, bonds payable, and more.

Shareholders’ equity is a term that generally refers to the net worth of a company. It reflects the amount of money that would be left if all assets were sold and all liabilities paid. This money belongs to the shareholders, whether they are a private owner or public investors.