Adjusted gross income (AGI) is equal to a taxpayer’s total income minus adjustments to income. AGI is the basic measure of income under the federal income tax and is the income measurement before deductions are taken into account. AGI is commonly used as the base for computing many of the limits under the tax law, such as those on the itemized deduction for medical and dental expense and miscellaneous itemized deductions.

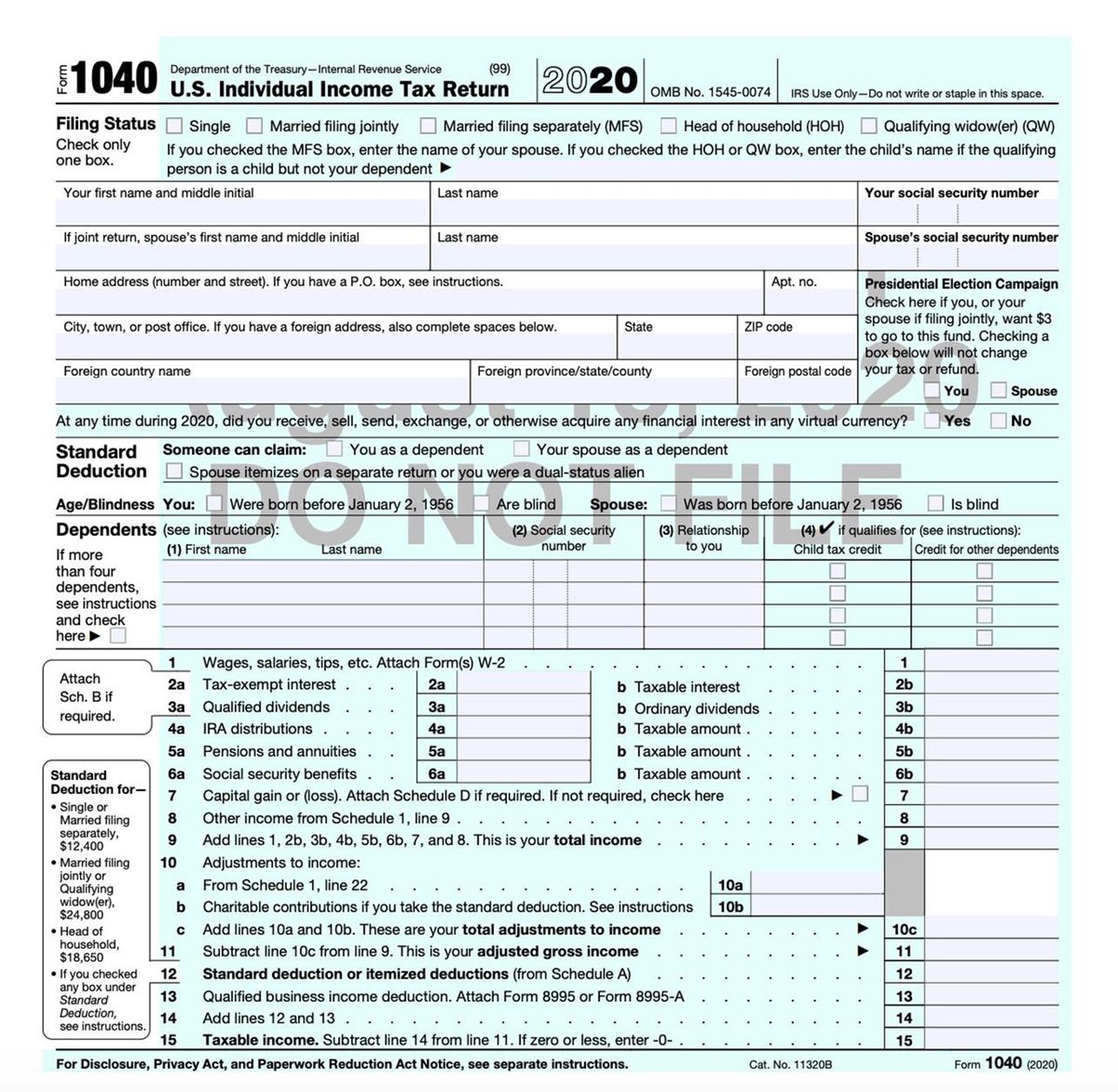

A taxpayer’s adjusted gross income is listed on line 11 of the Form 1040.

Incomeauto2

Federal Individual Income Tax Terms: An Explanation Updated February 4, 2021