Small businesses are a significant source of employment and provide a variety of goods and services. While Black Americans make up 13 percent of the U.S. population, they own less than 2 percent of small businesses with employees. If financial capital were more evenly distributed and Black Americans enjoyed the same business ownership and success rates as their white counterparts, there would be approximately 860,000 additional Black-owned firms employing more than 10 million people. A future presidential administration could meaningfully reduce small business dis-parities by revamping a long-neglected agency housed within the Department of Commerce.

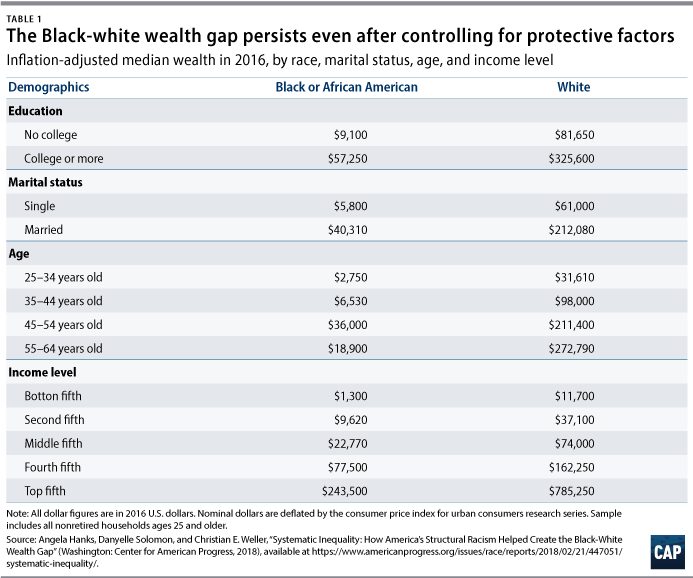

The United States is home to inseparable racial disparities in wealth, access to capital, and business ownership. Wealth and capital are a prerequisite rather than just a prod-uct of entrepreneurship. Black Americans have been systematically prevented from accumulating wealth and accessing capital for centuries. The typical Black household has just one-tenth of the wealth of their white counterparts.

Black firms are seven times less likely than white-owned firms to obtain business loans in their founding year. Black Americans make up approximately 13 percent of the U.S. population but receive just 3 percent of SBA loans. If these programs were equitably administered, Black firms would have received an additional $2.5 billion in loans.

Without wealth at the community level, existing Black-owned businesses may also struggle to maintain their financial footing during sustained economic downturns. During such periods, regular clients and customers may have fewer resources to support their local veterinarian, mechanic or contractor.

The current state of Black-owned businesses reflects persistent inequities in wealth and access to capital. The MBDA is well positioned to lead the federal government’s efforts to eliminate racial disparities in business ownership. Once established, these firms have potential to increase wealth, create jobs, and reduce persistent shortages of essential goods and services in Black neighborhoods, including health care, child care, and food. However, creating an environment where people of color—especially Black people—can start, grow, and expand their own businesses will require more than entrepreneurship seminars. The federal government must devote substantial resources toward increasing wealth and access to capital for all black Americans.

The Minority Business Development Agency began more than 50 years ago as the Nixon administration’s Office of Minority Business Enterprises. Congress has never passed authorizing legislation for this agency. In FY 2020, the MBDA had just $42 million in total available funds, constituting approximately 0.003 percent of total discretionary spending. For every $1,000 the federal government spent in 2020, it allocated just three cents to foster, promote, and develop minority-owned businesses nationwide. However, a significant expansion of MBDA resources would allow the agency to engage in a variety of activities to meaningfully reduce racial disparities in wealth, economic mobility, and business development.

Auto66