Step 1

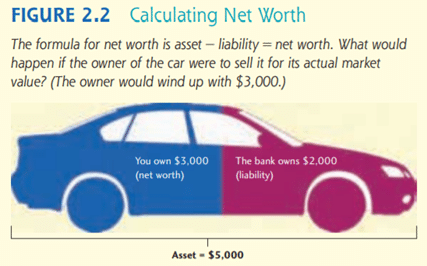

Budget planning is the process of forecasting future expenses and income. The first step in budget planning is to determine where you are right now financially. Answering these questions can help you to get an accurate picture of your current financial position. As you save money, you will accumulate more assets (including cash) and increase your net worth. You will also have the chance to reduce your liabilities, which will also increase yourNet Worth. The formula for determining your net worth is as follows: Assets – Liabilities = Net Worth

Think about it like this.

Step 2

A key factor in shaping a budget is understanding your income. How much income you have will determine many of the details in your budget. Think about the people you know. What jobs do they do? You will probably list a number of professions, some that require a college degree.

Step 3

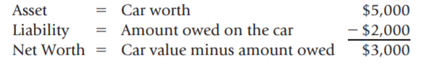

Identifying your Expenses. Your expenses are also important in your budget. Typical expenses might be clothing and entertainment. Some of you might even have a car payment and related expenses.

Step 4

The more money you make, the higher the share of your income you will pay in income taxes. As your income level increases, you will want to begin to include tax planning in your financial plan.

Personal Financial Literacy – Second Edition – Madura, Casey, Roberts – Pearson