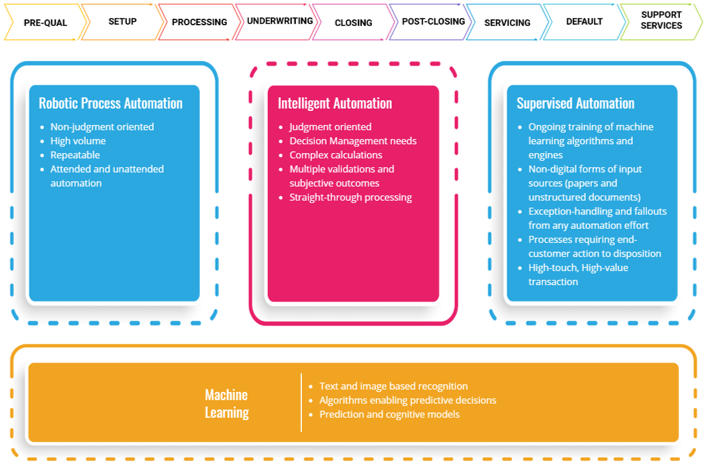

Lenders need business growth that is not linear and is not tied to the market cycles. Robotic process automation (RPA) can be used to handle repetitive, high-volume tasks. supervised automation involves human oversight for the ongoing training of machine learning algorithms and engines. The next level up from RPA is intelligent automation, which is capable of handling multiple validations and subjective outcomes.

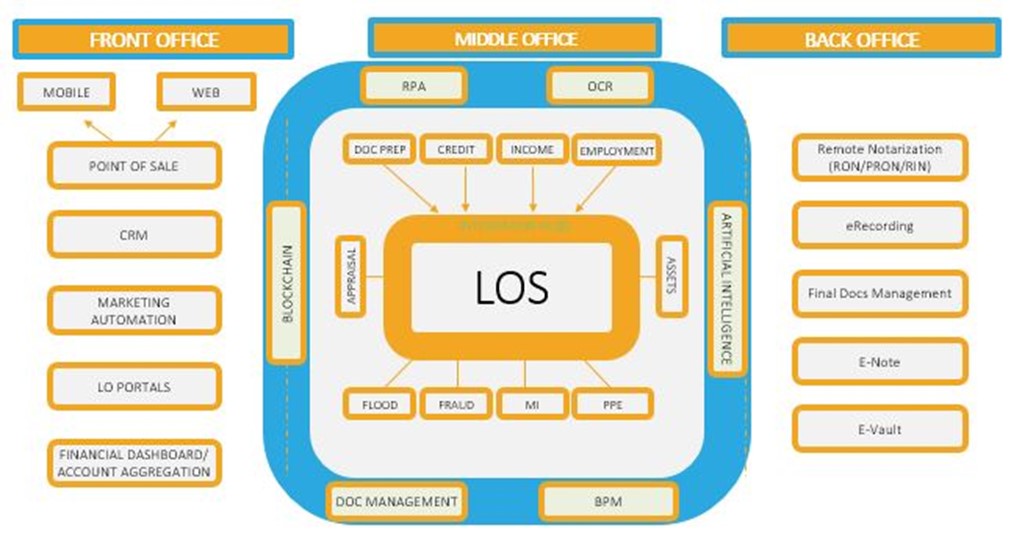

“Any function that is typically can be automated using RPA,” says Bharadwaj. Automation has been applied in the front office sections of the mortgage life cycle. The middle office functions are where Indecomm sees a majority of the potential for automation to make a difference in the near future. There are still opportunities for improvements to the process.

https://www.housingwire.com/articles/untying-business-growth-from-the-housing-market-cycle/