Machine learning can be used to predict borrower behavior. Machine learning could reduce losses on delinquent customers by up to 25%. Most companies infer only a small fraction of what is helpful from this data. In a study of data from over five years, including the financial crisis, MIT researchers found that machine learning could be use to reduce a bank’s losses.

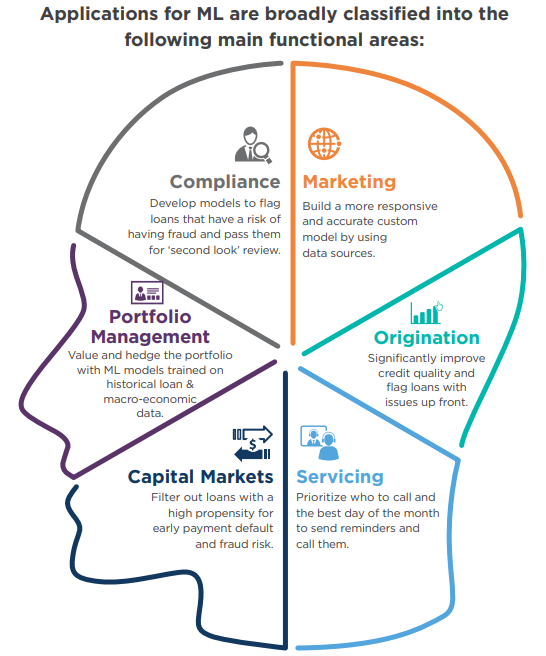

Machine learning tools access data through extensive mining from various sources such as online transactional behavior, purchasing behavior with e-commerce, social media activity, etc. This assures unbiased play with interest rates as per their creditworthiness, and the borrower getting listed in risk buckets.

Most lenders, especially mortgage lenders, have dismal closing ratios. The User Experience (UX) layer of the origination process has to be enhanced to capture telemetry data from various UX triggers. The ability to identify various traits of a lead that result in a higher likelihood of closing can drive better resource allocation and timely intervention.