The remaining agent types can be regarded as speculators of one kind or another:

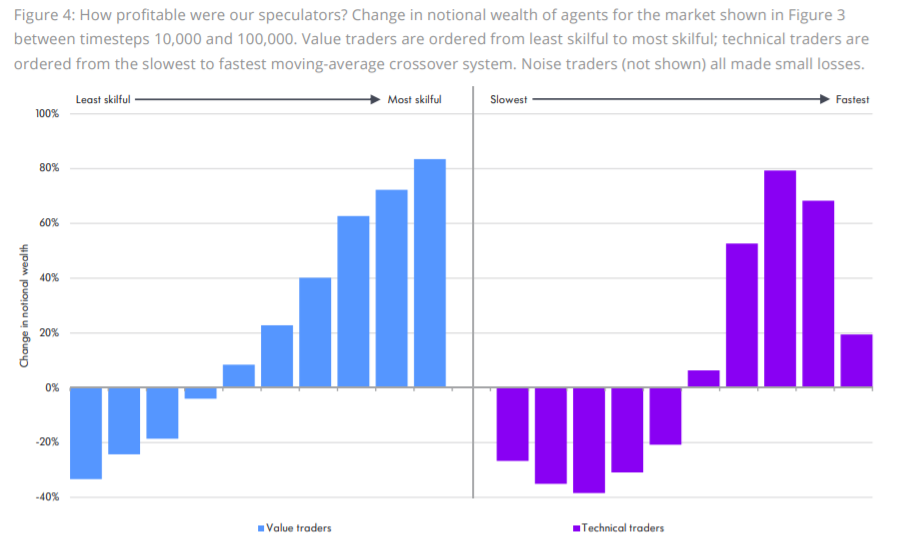

Value traders: This group attempt to infer the market clearing price, which they manage with some degree of random error (and, perhaps, a deterministic bias). That is, at each timestep, the agent assumes the asset has a “true” value equal to the clearing price for the physical market plus a Gaussian random deviate − the distribution of which depends on each agent’s skill. If the market price is sufficiently below the (inferred) “true” value, the agent will go long; then, once the market price climbs sufficiently above the market-clearing price, they will close out their position, and vice versa for short trades.

Technical traders: These take positions based solely on past prices. For the purposes of this paper, we consider only trend followers, which generate a signal using an exponentially-weighted moving-average crossover system. Position size depends on the strength of the signal and an estimate of the volatility via a function that scales the maximum possible position according to the trader’s current capital.

Noise traders: The desired position of noise traders follows a random walk − here, an AR(1) process to prevent the position diverging − and they trade to achieve that position. They provide volatility and volume – and profits for the market-maker – but, in fact, are not necessary to generate any of the interesting behaviour we see in our model.

If We Don’t Believe Markets are “Efficient”, What Do We Believe

Louis Bachelier’s Theory of Speculation: The Origins of Modern Finance