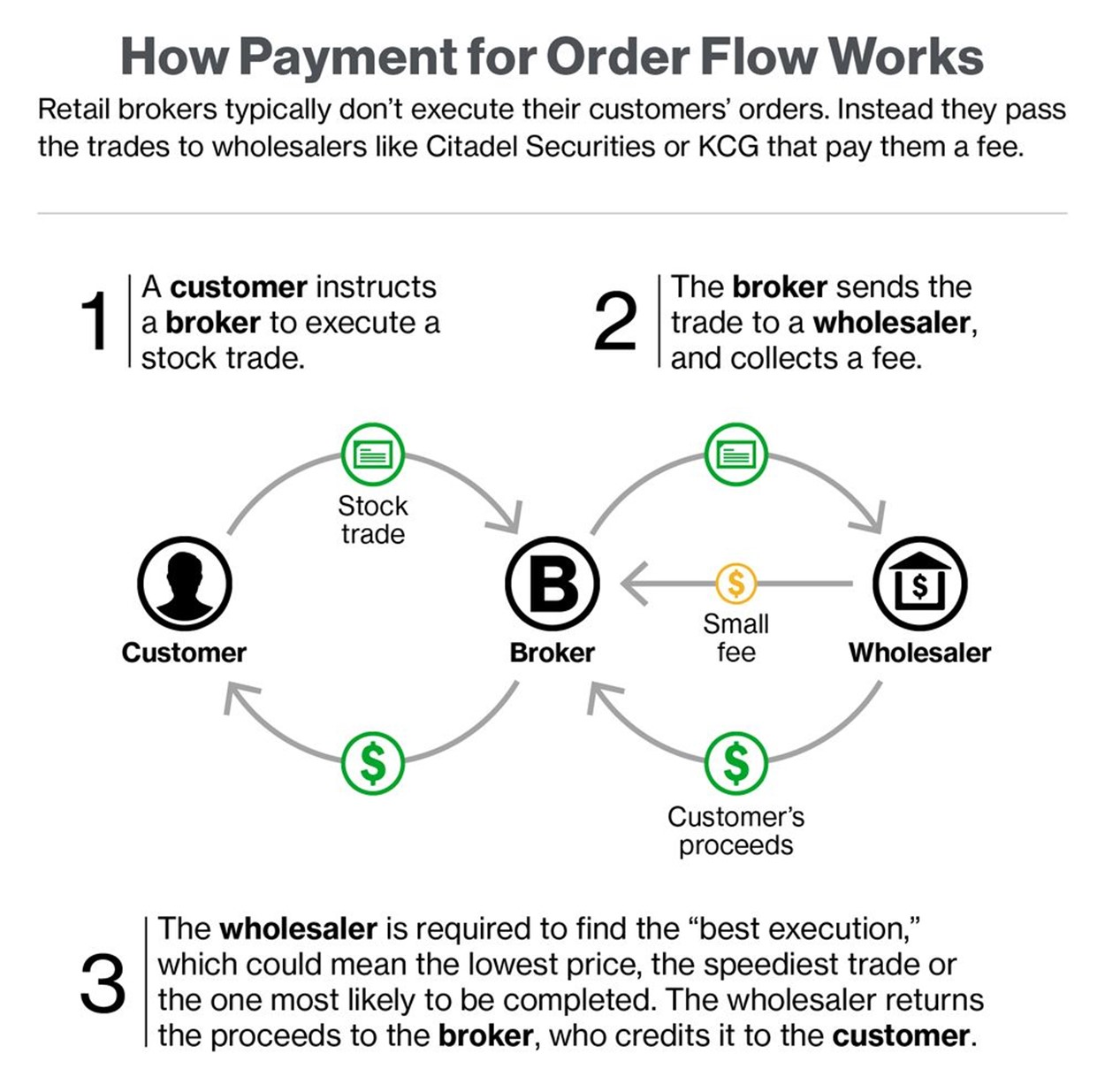

Payment for order flow (PFOF) is the compensation a broker receives for routing trades for trade execution. For options trades, the market is dominated by market makers since each optionable stock could have thousands of possible contracts in existence.

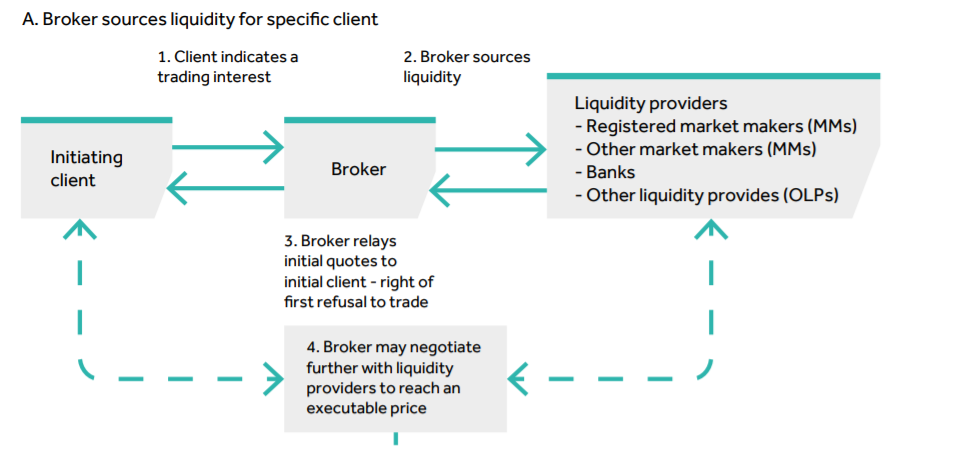

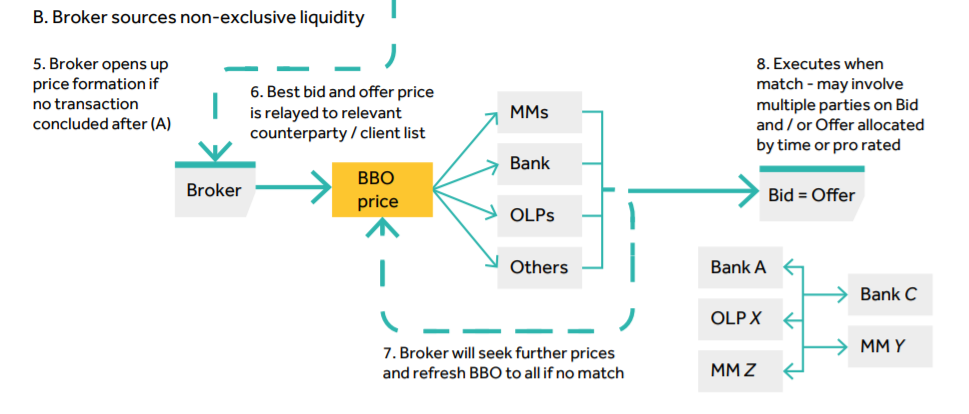

Given the complexity of executing orders on thousands of stocks that can be traded on multiple exchanges, the practice of being a market maker has grown. Market makers are typically large firms that specialize in a set number of stocks and options, maintaining an inventory of shares or contracts and offering them both to buyers and sellers. Market makers are compensated based on the spread between the bid and ask prices. Spreads have been narrowing, especially since exchanges transitioned from fractions to decimals in 2001. A key to profitability for a market maker is the ability to play both sides of as many trades as possible.

SEC Special Study: Payment for Order Flow and Internalization in the Options Markets

17 CFR § 242.606 – Disclosure of order routing information

PFOF is when a firm pays a commission to a client for an order to be carried out. PFOF can also lead to a loss of market integrity, as the firm pays for the order rather than the client. Payment for Order Flow (PFOF)