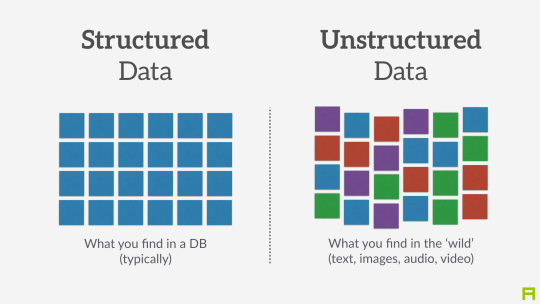

Data collected from transactions is in the form of structured data. Structured data easily fits into rows and columns. These columns usually are fields of fixed length. An example would be 10 digits for a phone number. Customer name, credit card number, and total dollar amount of sales are other examples of data that easily fits into rows and columns. Companies also collect unstructured data. Unstructured data does not easily fit into rows and columns of fixed length. An example of unstructured data would be the free form text of a customer’s online review of a product. It might include Facebook posts, tweets, video, and other free form types of data.

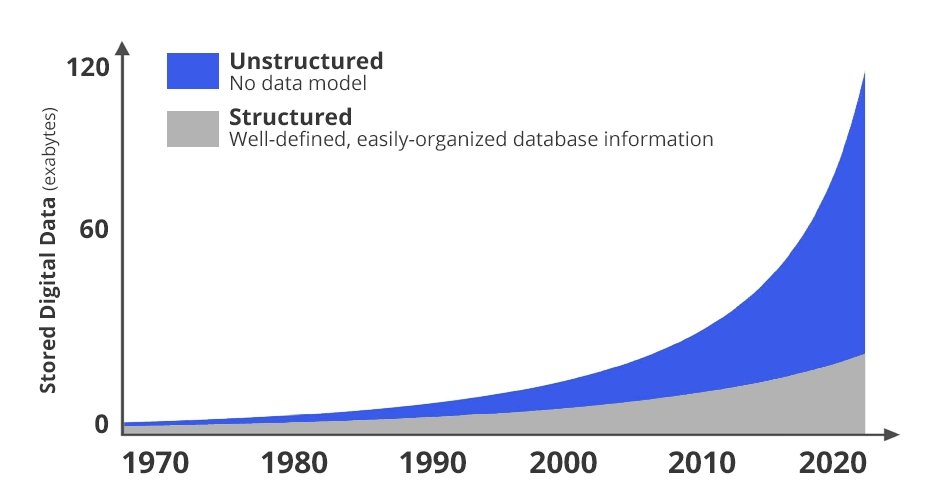

Since most accounting data is structured data, the remainder of this chapter describes the typical storage and processing techniques used in organizations to manage their structured data. Organizations accumulate a mountain of structured accounting data resulting from their numerous business transactions. This includes account numbers, dollar amounts, and other financial data from business transactions. Sometimes, the volume of data may seem overwhelming; but as long as it is structured data, it can be easily stored and organized by most accounting systems. However, accountants are evolving toward using more unstructured data. As companies collect more data from more sources, Big Data becomes a critically important resource that accountants must use. Big Data is known as high volume, high speed information that may be so large and diverse that it demands innovative forms of IT processing.

Auto263