Business travel is notoriously difficult to assess due to a lack of data on the market size and nature on a global scale. Market estimates tend to be localized, produced either by aviation or tourist authority surveys of passengers at airports, or surveys by (perhaps partisan) buyer organizations. Various researchers have sought to assess the overall impact of communication technology on the push-me, pull-you drivers of substitution v. generation on business travel. None have, to date, provided a sufficiently robust set of results to be able to determine, with any degree of certainty, the future of the business travel market.

The arrival of coronavirus (C-19, hereafter) has had a devastating impact on the demand for air travel. Many workers were made redundant, whilst many others were sent to work at home. Extensive use of home working has led to a significant uptake of videoconferencing technologies. It is therefore the right time to re-evaluate whether Zoom, and MS Teams, will have a long-term impact on business-related air travel and to assess what impacts that might have on the airlines. Using the International Air Transport Association’s 2019-2039 general market forecast, this paper develops an estimate of the future size of the business travel market.

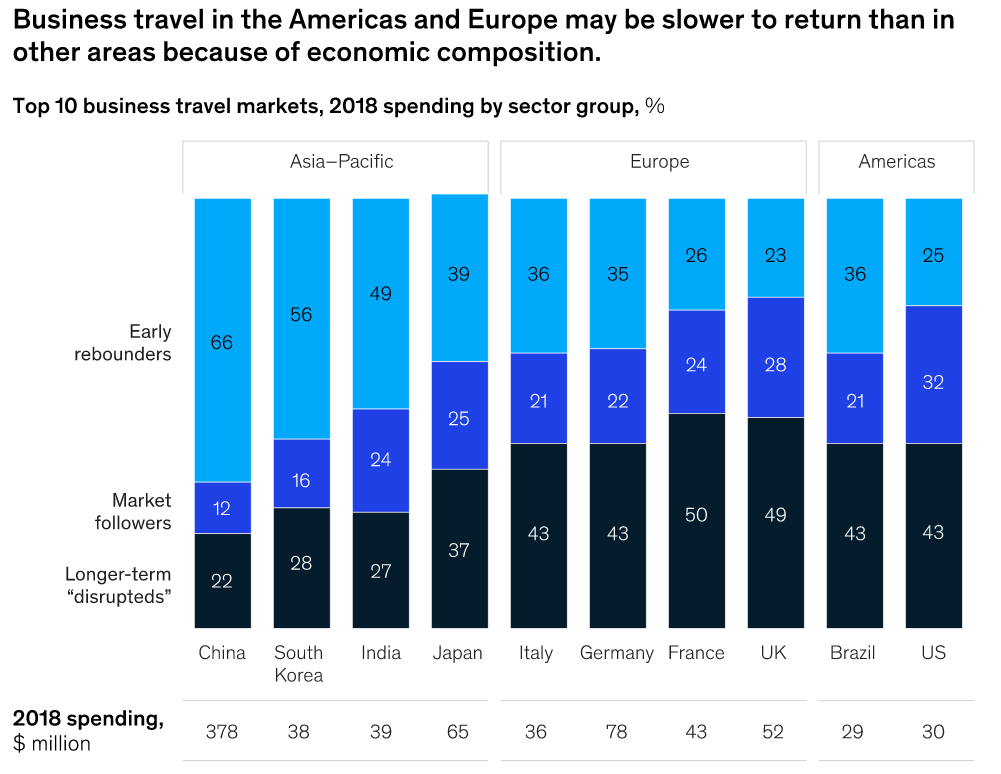

Business-related air travel fell from 45% in 1996 to 30% in 2007. Business travel fell to just 19.5% of the market by 2018. The fall is because the market is growing at a slower rate than that of the leisure travel market. Today the market for business induced air travel is somewhere around 25-30% of. the market globally. As business confidence increases, so does business travel. When there are economic crises such as SARS, oil crises, or the financial crash of 2008, business travel falls.

Business-related air travel market displays elements of industrial purchasing with many companies setting travel policies for their travelers. The market’s behavior depends on the volume of air travel purchased and is divided by those companies with enough buying power to leverage special deals with airlines on a volume for discount basis. Although companies tend not to reveal how much they spend on business travel, around just less than half work for companies that are not managed and tend to have fewer employees.

Auto215

Covid-19 and the long-term implications for the business travel market